- Joined:

- Jul 12, 2013

- Posts:

- 21,141

- Liked Posts:

- 15,169

- Location:

- The sewers

My favorite teams

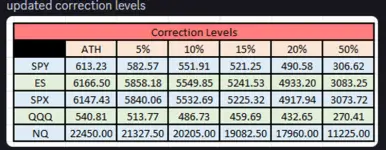

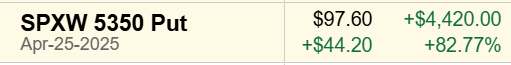

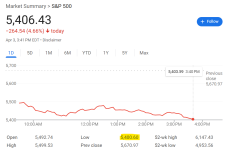

thats like 2%, so prolly lolBeen another really good week for Puts. Confident next week S&P gets into the 5400's.

question is, where does it go from there and how long does it stay down. we did just have 4 winning days in a row that went up till wednesday, so if today hadnt gone south so hard this week would not of been good for the puts