Heres todays SPY Daily chart im trading off of tomorrow. Its obviously very bearish as you can see we close at the days low which is usually a sign that we will continue to seek a bottom AH and open even lower tomorrow. I think there is a 50/50 chance we retest the 540 demand level tomorrow although given whats going on right now i would be shocked if we break it. I have a weekly demand level not shown on this chart at 532.86 and I think this will be tested as well tomorrow.

I kept about half my put position overnight and locked in the other half, my general strategy tomorrow will be to wait and see early but start to buy Puts at $2 increments (538,536,534,532 etc.) if/when we get close to 540, and then be very quick to sell as we approach 532 if it bounces. I dont expect to breach 532 in one go, for example SPY bounced off the 540 demand level twice today - once at 11:06 and once at 2:30 before finally breaking through it at 3:16. I suspect we will see early pricing drop after open but turn and retrace up to near 540 before rejecting around mid day and going back down to 532ish, repeating a similar price pattern we saw today and most of Monday.

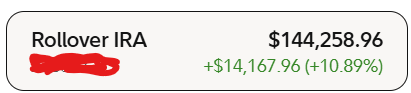

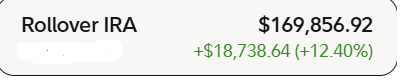

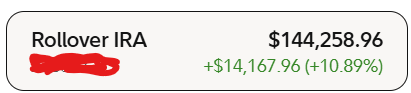

I had a really good day of trading today, the market hit almost all of my targets to the tee and I was able to cash in big returns with investing only about 30% of my dry powder. I am still mostly cash as we get closer to the bottom of my channel the risk of a rebound becomes significantly greater. Wish me luck for tomorrow.

now